🚩 Why is my PIN flagged?

Why can’t my clients claim VAT from my invoice?

What even is the VAT Special Table?

If you’re asking any of these questions — you’re not alone. Thousands of Kenyan businesses are listed on the KRA VAT Special Table and don’t even know it.

In this post, you’ll learn:

✅ What the table means

✅ Why your PIN is flagged

✅ How to get removed from the list — step by step

✅ How to prevent future listing

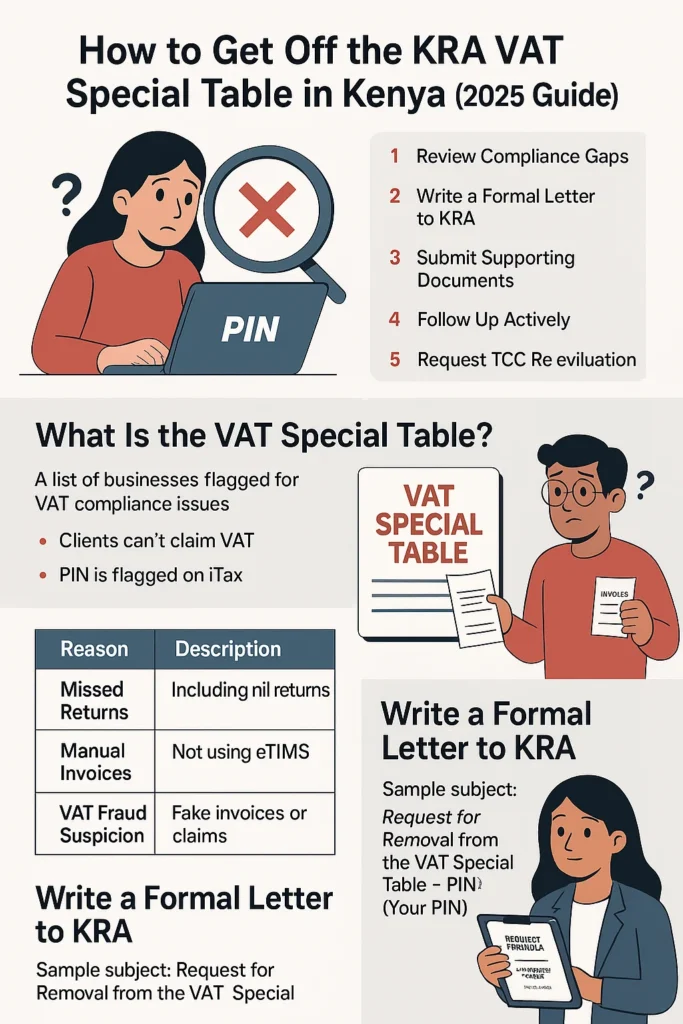

🧠 What Is the VAT Special Table?

The VAT Special Table is a KRA tool that flags non-compliant VAT-registered taxpayers.

If you’re listed:

- Clients cannot claim VAT from your invoices

- Your PIN is red-flagged on iTax

- You may be denied a TCC (Tax Compliance Certificate)

- Your eTIMS account is locked

🔗 Check Your PIN Status on KRA Portal

🚨 Why Is Your PIN on the Special Table?

🚨 Why Is Your PIN on the Special Table?

| Reason | What It Means |

|---|---|

| ❌ Missed VAT returns | Filing delays or skipped nil returns |

| ❌ Unpaid VAT | Filed returns but didn’t pay VAT due |

| ❌ Not using eTIMS | Still issuing manual or Excel invoices |

| ❌ Suspicious declarations | Unrealistic sales, fake claims |

| ❌ VAT refund audit trail issues | Risk flagged from verification |

| ❌ Variance in eTIMS vs VAT returns | You’re declaring less sales in VAT returns than what was transmitted via eTIMS — this is seen as sales underdeclaration |

🔍 KRA is now auto-matching eTIMS invoice data with VAT returns. If there’s a mismatch — especially if you report lower figures — you may be flagged as high-risk.

🔍 How to Know You’re on the List

- Your can’t file your VAT returns on iTax

- Clients reject your invoices

- You fail to get a TCC

- You receive an email/letter from a Tax Compliance Officer

✅ Step-by-Step: How to Get Off the VAT Special Table

1️⃣ Review Your Compliance Gaps

- Check your VAT compliance status on itax PIN checker

- Compare your etims invoices vs the VAT autopopulated return

- Ensure you’ve started using eTIMS

- File and pay your VAT tax dues on time

2️⃣ Write a Formal Letter to KRA

Subject:

Request for Removal from the VAT Special Table – PIN [Insert PIN]

Include:

- Company details (PIN, registration)

- A brief explanation of the issue

- What you’ve done to correct it

- Request for urgent removal

3️⃣ Attach These Documents

📎 Required documents:

- Company PIN & registration certificate

- eTIMS invoice samples

- Bank statements (3–6 months)

- Filed returns + proof of VAT payments

🧾 Upload via iTax or deliver physically to your Tax Station.

4️⃣ Actively Follow Up

- Contact your Tax Compliance Officer

- Visit the station if no response

- Send email reminders weekly

⏳ Cases can drag for weeks if you don’t follow up!

5️⃣ Request a TCC

Once your PIN is cleared:

- Go to iTax

- Apply for a TCC

- Confirm your removal is effective

❌ What to Avoid After Removal

To prevent being flagged again:

- File returns monthly (even nil)

- Use eTIMS when invoicing

- Pay taxes on time

- Reconcile bank income with VAT returns

- Avoid questionable “bulk” input claims

📥 Download Our Free Checklist

👉 Download the Special Table Removal Checklist (PDF)

Use it to tick off every step during the process

🎥What is the VAT Special Table?

🙋 Frequently Asked Questions (FAQ)

Q: How long does removal take?

A: 2 to 6 weeks with active follow-up.

Q: Can I still invoice while flagged?

A: Yes — but your clients can’t claim VAT.

Q: Can Ushuru help with this?

A: Yes! We assist with submissions, eTIMS setup, and follow-ups.

📞 Final Call to Action

Being flagged isn’t the end — but staying silent will cost you business.

📩 Talk to a Tax Expert Now

📎 Or grab the Checklist PDF

Tags: #VATSpecialTable #eTIMS #KenyaTaxHelp #KRACompliance

Category: Tax Compliance, VAT, eTIMS